For FinTech, the last 2 years were all about innovation and breaking barriers. Mental barriers but mostly geographical ones.

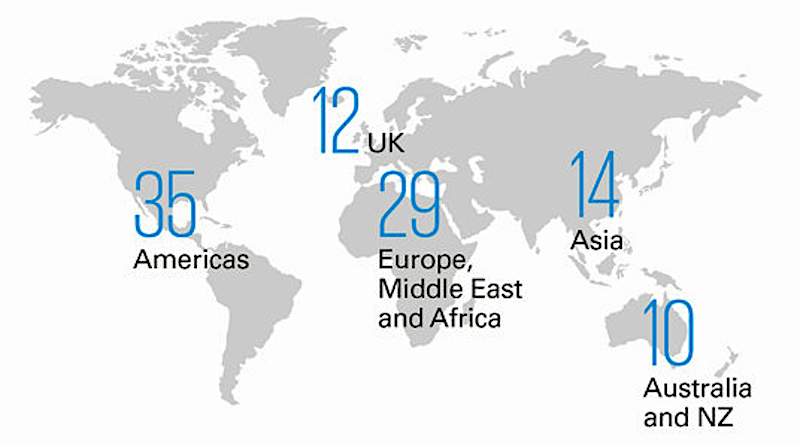

In a study conducted by KPMG and H2 Ventures, 17 different countries are represented in the “Fintech 100 – Leading Global Fintech Innovators” top.

And here’s the global representation:

This report identifies the leading 50 ‘Established’ FinTech companies across the globe, and the most intriguing 50 ‘Emerging Stars’ – exciting new fintechs with bold and disruptive ideas.

“More capital than ever is invested around the world in startups that are creating new financial products and solutions” [source]

Here you’ll find the complete study but let’s see some key points:

- China now tops the global rankings– within 3 years, China’s FinTech ventures have gone from only one company included in the top 50 rankings in 2014, to this year China featuring 4 of the top 5 companies and 8 of the top 50

- Disruptors dominate– 9 of the top 10 companies on the list are FinTech ‘disruptors’ (and 46 of the top 50)

- Lending returns to the fore– 23 of this year’s top 50 (and 32 in the 100) have business models related to lending (up from 22 last year).

- Insurtech continues its climb– with 12 insurance fintech companies in this year’s list, almost double last year’s total.

- Emergence of regtech– with 9 fintech companies focused on regulatory solutions in the list this year.

- Mega funding rounds – the size of deals/funding rounds above US$1bn have continued to rise, including Ant Financial, Lufax and JD Finance.

- Aggregate level of capital raise continues to rise– reaching a total of US$14.6bn of capital raised since last year’s report (12 months ago).

A new approach to innovation in FinTech

FinTech’s influence on Financial Services is growing year over year and, according to a new PwC global report “the majority of global Financial Services companies plan to increase FinTech partnerships“.

In addition, 82% of incumbents expect to increase FinTech partnerships in the next three to five years and 77% of them expect to adopt blockchain as part of an in production system or process by 2020.

“The Financial Services industry will be unrecognizable in 5 years. The innovators of today will not necessarily be the innovators of tomorrow” PwC global report

6 factors that will help you prepare for the future:

- Evaluate emerging technologies

- Take a partnership perspective

- Integrate to innovate

- Create an IT culture that will support innovation

- Concentrate on the customer’s voice and shift thinking to outside in

- Foster a company culture that supports talent and innovation

The best in FinTech

FinTech has become a market of billions of dollars: “after hiting $19 billion in total in 2015, worldwide FinTech funding hit $15 billion by mid-August 2016. The U.S., Europe, and the Asia-Pacific (APAC) region led the way in attracting the most fintech investment“. [source]

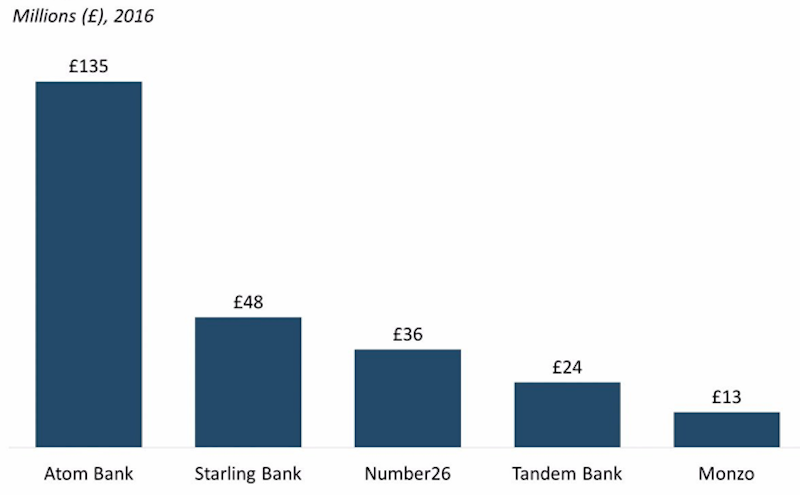

- below, total funding raised by major European digital-only banks [BusinessInsider]

“The $1.7 trillion U.S. financial services industry is being fundamentally reordered as a tsunami of technology disrupts the way we save, invest, spend and borrow” Forbes

Under these circumstances, Forbes has made a Top 50 FinTech startups & companies – and here are some of their nominees:

- Activehours – Mobile app allows worker to get a portion of his paycheck, for hours already worked, deposited into his bank account before payday, with the fee for this advance set by the user

- CircleUp – Crowd funding site connects entrepreneurs developing new consumer products with potential distributors and financial backers. A new “Classifier” tool uses 90,000 data points to help potential investors evaluate a company

- Gusto – Cloud based software helps smaller businesses, most under 100 employees, administer payroll and payroll taxes, health insurance, workers’ compensation and 401(k) plans

- TransferWise – Peer-to-peer app for transferring money around the world has software that invisibly matches unrelated customers’ orders to limit how much currency actually crosses borders. Aims to charge 80% less than a bank. Just launched service for business transfers, too.

Furthermore, Business Insider has rounded up the 40 most exciting people in the UK FinTech scene:

- CEO & CoFounder @ Monzo Bank, Tom Blomfield was on top of that list and the main reason is that Monzo represent the fast-growing London FinTech app that’s creating a branchless bank.

We talked about billions of dollars but here’s another truth: according to the World Bank, there are two billion people globally who currently have no access to banking services.

And FinTech must find a solution for those people, also.